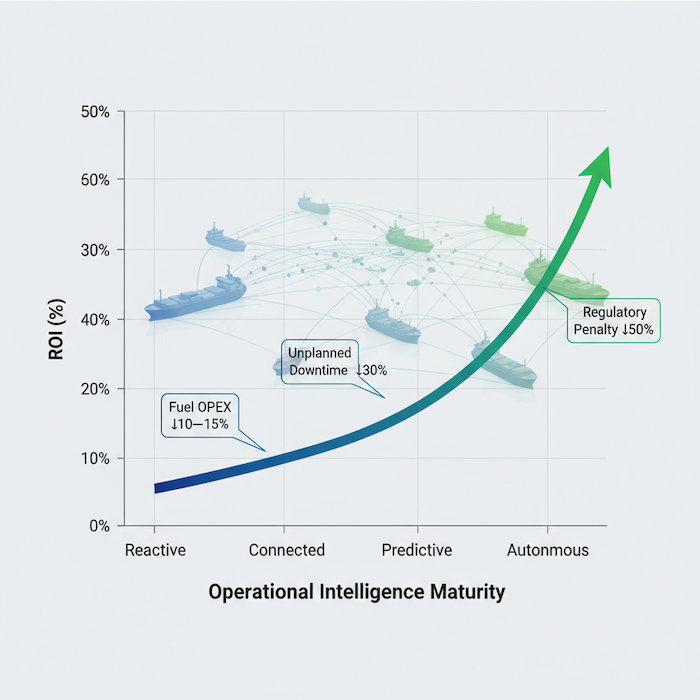

This article is the first in a two-part series exploring the Total Cost of Risk (TCOR) and Return on Investment (ROI) of fleet-level Operational Intelligence (OI).

Introduction: From smart vessels to KPIs that drive fleet performance

Operating in today’s maritime environment – defined by financial volatility, regulatory pressure and a hardening insurance market – requires C-level executives at shipping companies to achieve an unprecedented level of strategic financial discipline. The industry must now execute a critical shift: moving to leverage necessary but isolated single-vessel optimisation by scaling that core efficiency data into unified, real-time intelligence across entire vessel portfolios. This article provides the data-driven blueprint for this necessary transition, utilising verified case studies to demonstrate the competitive metrics that drive immediate, profitable decision-making. This approach fundamentally redefines maritime operations by providing immediate, verifiable decision support for shipping company leaders.

A delayed investment in advanced fleet intelligence is not merely a missed opportunity for marginal efficiency gains; it signals a profound strategic liability. The ability of competitors to actively capture market share and efficiency gains makes this a matter of competitive urgency. The following case studies and industry benchmarks frame fleet intelligence around four measurable executive outcomes: reduced Total Cost of Risk (TCOR) – a unified metric encompassing safety and insurance costs – guaranteed fuel savings and lower OPEX, avoidance of punitive regulatory penalties and maximized asset utilisation (Return on Capital Employed, or ROCE).

The urgency: Why OI is now non-negotiable

The core challenge facing executive leadership today is converting market complexity into competitive advantage. The persistent volatility in OPEX and fuel prices requires instant efficiency gains, while tightening international and regional emissions rules (CII, FuelEU Maritime) introduce severe financial penalties for inaction. These pressures mean that relying on traditional, fragmented data systems is no longer a viable risk-management strategy. The strategic value of fleet-level OI lies in its ability to generate savings, secure asset uptime and proactively mitigate escalating financial and regulatory liabilities before they impact the bottom line.

Defining Operational Intelligence: aggregation to action

Effective fleet-level operational intelligence (OI) is the centralised process of aggregating diverse, real-time data streams across all vessels and synthesising that information into a unified, predictive operational picture. Unlike simple vessel performance monitoring, OI integrates data directly into executive dashboards, transforming raw operational metrics into actionable financial leverage.

This predictive synthesis enables leaders to pull decision levers informed by high-level organisational KPIs, such as fleet OPEX trends, regulatory risk forecasts and overall asset health status. This high-level visibility is crucial because it connects specific operational variables (e.g. speed, near-miss frequency, hull fouling) directly to quantifiable financial impacts, allowing management to anticipate problems and capitalise on efficiency opportunities faster than traditional manual processes allow. The ability to make data-backed decisions swiftly is the core driver of accelerated ROI.

Types of data powering executive decisions

OI platforms synthesise data from multiple cohorts to deliver value across the enterprise:

- Operational (engine/fuel): Data on engine health, specific fuel-consumption profiles and vessel performance. Tied to: OPEX reduction and investment ROI.

- Navigational/safety: Real-time situational awareness, near-miss logs and crew behavioural metrics. Tied to: Incident reduction, insurance risk, and TCOR.

- Regulatory/emissions: Automated collection of data for IMO Data Collection System (DCS), CII and FuelEU compliance. Tied to: Penalty avoidance and brand equity.

- Environmental: Weather, sea state and currents used for dynamic route optimisation. Tied to: Fuel savings and on-time delivery rates.

Operational efficiency – Fuel OPEX, uptime and margin gains

Fuel remains the single largest controllable expenditure in vessel operations. OI focuses on dynamic route optimisation, maximizing asset uptime and increasing asset utilisation (ROCE).

Quantifiable results:

Fuel consumption: Dynamic route optimization requires leveraging vast amounts of real-time environmental data. This AI-driven weather data aggregation enables precise route planning, delivering measurable efficiency gains. The IMO publicly acknowledges that standard weather routing services provide measurable fuel consumption savings of at least 3% in fuel consumption for the general fleet, rising to as high as 10% for vessels like large container ships that are susceptible to weather and sea-state variations (https://stormgeo.com/insights/the-hidden-roi-of-ship-routing-services).

Proactive hull maintenance: Leading operators prove the value of linking continuous performance monitoring to maintenance. For example, global heavy-lift operator AAL Shipping actively monitors fuel-consumption benchmarks and undertakes regular hull cleaning and propeller polishing at six-month intervals. This proactive approach, combined with fuel-efficient voyage planning, led to a consistent reduction in fuel consumption for certain classes of vessels between 2022 and 2024 (https://schoeller-holdings.com/wp-content/uploads/2025/06/AAL-Sustainability-Report-2024.pdf).

Dynamic speed optimization: Euronav, a major tanker company, demonstrated the savings from dynamic speed adjustment during a pilot voyage of a Suezmax tanker. A proactive slower speed instruction based on charterer’s requirements resulted in a quantifiable saving of 43 metric tonnes (mt) of fuel for that single voyage (https://globalmaritimeforum.org/insight/enablers-and-challenges-to-operational-efficiency-pilots/).

Predictive maintenance and ROCE: OI platforms eliminate unplanned downtime – the most significant threat to ROCE – by enabling predictive maintenance.

Downtime reduction example: Leading container line Maersk implemented AI-powered predictive maintenance across its fleet. Their systems analyse over two billion data points daily from over 700 vessels, achieving an 85% accuracy rate in predicting equipment failures. The aggregate impact is a 30% reduction in unscheduled maintenance vessel downtime, resulting in estimated savings of over USD 300 million annually across its fleet (https://docshipper.com/logistics/ai-changing-logistics-supply-chain-2025/).

Why real-time analytics accelerate ROI

The common thread across these operational pillars is the financial value of time. OI accelerates ROI by collapsing the time between event detection and decision-making, which is measured by the reduction in Mean Time to Resolution (MTTR). This speed minimises costs in three key areas:

Avoided breakdowns: Predictive maintenance capitalises on lead time, such as predicting equipment failures weeks in advance (up to three weeks in Maersk’s case), allowing proactive scheduling that avoids costly unplanned downtime and emergency repairs.

Route efficiency gains: Dynamic route optimisation enables teams to act on fleeting opportunities. Euronav’s pilot demonstrated savings of 43 mt of fuel by adjusting speed 10 days before ETA, capitalizing on efficiency gains that would be lost with slower analysis.

Reduced TCOR: Faster, verified data simplifies complex incidents. By providing immediate event logs, OI can expedite claims resolution, support legal defence and drastically reduce the financial drag associated with administrative and investigatory overhead, thereby lowering the TCOR.

In Part 1, we’ve demonstrated how OI generates fundamental gains in efficiency, OPEX reduction, and asset utilisation (ROCE). To understand the strategic defence this data provides – and how it directly lowers insurance and regulatory costs – read Part 2: How Data Transforms Safety, Compliance and Risk.

FAQs

How does fleet-level operational intelligence directly impact key executive metrics such as fuel cost, safety and regulatory compliance?

Fleet-level operational intelligence gives management a consolidated view of vessel performance, enabling proactive decisions on routing, speed and maintenance. This directly cuts fuel consumption, improves navigational safety by identifying high-risk patterns and ensures continuous compliance through automated emissions and performance reporting.

What ROI improvements can ship operators achieve by aggregating and analysing real-time operational data across their fleets?

By aggregating and analysing real-time data, operators can reduce fuel and operational costs, lower incident rates, optimise maintenance cycles and avoid non-compliance penalties. Data-driven decisions also improve charter performance and asset utilisation, raising overall fleet ROI.

What are the financial consequences of failing to meet current maritime emissions regulations (EU ETS, FuelEU Maritime, IMO CII) at the fleet level?

Non-compliance with regulations imposes immediate, quantifiable direct costs coupled with potentially devastating, long-term indirect capital impairment across entire fleets. Direct liabilities include the EU ETS penalty (€100 per tonne CO2 plus allowance cost), with persistent failure risking fleet-wide trade bans and denial of port access. Furthermore, FuelEU Maritime mandates significant energy deficit fines (€58.50 per Gigajoule (GJ), escalating progressively for repeat offenses. Simultaneously, poor CII ratings (D/E) trigger profound commercial erosion, leading to discounted charter rates and the transformation of inefficient assets into “brown” ships with accelerated depreciation and stranded asset risk. Successful fleet strategy demands proactive capital expenditure to mitigate this cumulative financial burden.

How can predictive risk profiling and partnerships with technology vendors reduce insurance costs for shipping companies?

Predictive risk profiling allows insurers and operators to quantify and mitigate operational risk before incidents occur. Demonstrating reduced collision risk or safety violations through verified data can lower premiums and strengthen insurer confidence, especially when supported by technology vendors offering validated safety analytics.

What steps are required to integrate shore-based and onboard operational intelligence systems for maximum transparency and collaboration across the fleet?

Integration requires standardised data formats, secure cloud connectivity and alignment of onboard sensors and bridge systems with shore-based analytics platforms. Establishing unified dashboards and workflows ensures transparent, real-time collaboration between crews, fleet managers and compliance teams, turning fragmented data into actionable insight.